This blog covers the stocks that are part of the GDT::Portfolio.

Monday, December 31, 2012

Bought Some Altair Nanotechnologies (ALTI)

Bought Some NeuroMetrix (NURO)

Friday, December 28, 2012

Bought Some Aastrom Biosciences (ASTM)

Bought Some Facebook (FB)

Today (02012.12.28) FB opened at $25.49 and that is the price our buy got executed. Between the open and now (~8:19am MST) FB had an intra-day low of $25.15.

Our FB investment is underwater with our average cost per share at $27.15.

Thursday, December 27, 2012

Bought Some Mace Security International (MACE)

Wednesday, December 26, 2012

Bought Some StemCells (STEM)

Monday, December 24, 2012

Geeknet Needs Geeks To Think ThinkGeek

Geeknet is ThinkGeek. I'm still bummed that Geeknet got rid of Slashdot. I hope ThinkGeek is having a busy end of year. I hope when geeks think about buying geeky stuff, they think ThinkGeek.

Sold Some CRAY At 5 $Pi ($15.71)

CRAY closed yesterday (02012.12.23) at $15.59. 52-week range: $6.09 - $15.81.

While I was writing this Cray posting, CRAY spiked to a new 52-week high of $15.87.

Friday, December 21, 2012

iRobot On My Mind

On 02012.02.08, IRBT closed at $38.30. One day later, on 02012.02.09, IRBT closed at $25.17. It subsequently fell to its current 52-week low of $16.25 on 02012.11.16.

I'd like to think the downside for IRBT is almost none. At 9:03am MST on 02012.12.21, IRBT was at $18.69 giving the stock a PSR (Price Sales Ratio) of 1.13 (I think this is low). iRobot has approximately $6.84 per share with $0 debt. Short Interest Ratio for IRBT is 11.9 (I think this is high).

[update::02012.12.23] Yikes! Yesterday (02012.12.22), after I posted this posting about iRobot, IRBT dropped 4.31% and closed the day at $18.20. Trading volume was 2.88 million vs. a trailing-3-month average of 0.28 million.

Red Hat Reports 3Q'12 Results

From Red Hat's 3Q'12 press release.

Total cash, cash equivalents and investments as of November 30, 2012 were $1.35 billion. [...] In Q3, we used our strong balance sheet and cash flow to repurchase approximately $52 million of common stock.

RHT closed yesterday (02012.12.20) at $52.61. 52-week range: $40.34 - $62.75. RHT is well below the accidental quadruple price of $67.48.

[update::02012.12.21] Oops... I wanted to make the following observation. At the end of 2Q'12, Red Hat had "total cash" of $1.36 billion. The company ended 3Q'12 with $1.35 billion in cash, yet it spent $52 million on its own shares.

Thursday, December 20, 2012

Illumina Spikes On Roche Speculation

Wednesday, December 19, 2012

Altair Nanotechnologies No Longer a Penny Stock

Hmm... Six times $0.47 is $2.82; therefore, ALTI opened down 17% and at one point it was down almost 19%. For the day it was down 12.4%.

There are now approximately 11,589,652 ALTI shares. Finance.Yahoo.com shows that ~63% of ALTI shares are closely held. If true, then ALTI has a float of ~4.3 million shares.

Tuesday, December 18, 2012

Cray Likes Germany

From the press release.

"With these large installations in Berlin and Hannover, Cray continues to strengthen its presence internationally and expand its coverage across the European HPC landscape."

CRAY closed yesterday (02012.12.17) at $14.83. 52-week range: $6.08 - $15.14.

Stewart Enterprises Still Not It's Own Customer

During the fourth quarter of 2012, the Company repurchased 1.1 million shares of its Class A common stock for $8.3 million under its stock repurchase program.

STEI bought back 1.1 million shares at an average price per share of $7.54 per share. In addition, during FY'12 the company reduced the total number of shares by 3.5%.

STEI closed yesterday (02012.12.17) at $7.53. 52-week range: $4.92 - $8.65. According to Finance.Yahoo.com, the Short-Interest-Ratio (SIR) for STEI is a whopping 48.1.

Unless our financial situation dictates otherwise, the plan it to hold onto a small amount of STEI shares until either the company or I go belly up.

Sunday, December 16, 2012

Google Hires Ray Kurzweil

MDBX (MedBox) is a Bit Volatile

MedBox Added To GDT::WatchList

MedBox (MDBX) is not a GDT::Portfolio stock, but W. Hollywood, CA-based company's stock has had an interesting trading history. Went public at $3.25 on 29 Aug 02012; hit an intra-day low of $0.05 on 28 Sep 02012; hit an intra-day high of $215.00 on 25 Nov 02012; closed at $23.50 on 04 Dec 02012. According to Finance.Yahoo.com, there are approximately 11 million MDBX shares outstanding with an approximate 1.91 million float. On 03 Dec 02012, MedBox issued a press release about a "patent pending storage and retrieval lockbox system called the Lockbox Rx." Prescription Vending Machines, Inc. is a MedBox subsidiary.

MDBX closed at $66.75 on 02012.12.14. The day's range: $61.10 - $110.00.

Thursday, December 13, 2012

Apple and Google on 12/12/12

12/12/12 is history, but here's a 12/12 tidbit that I missed on 12/12/12. Apple Inc. went public on 12/12/[19]80 and it ended 12/12/80 with a market value of ~$1.778 billion. Apple Inc.'s market value at the end of 12/12/12 was ~$507.03 billion.

AAPL closed yesterday (02012.12.12) at $539.00, well below its 52-week high of $705.07.

Google (GOOG) is a GDT::Portfolio stock and it closed yesterday at $697.56. 52-week range: $556.52 - $774.38. Google Inc.'s market value at the end of 12/12/12 was ~$229.21 billion.

Wednesday, December 12, 2012

Nanosphere Gets Yet Another FDA Approval

NSPH closed yesterday (02012.12.11) at $2.79. 52-week range: $1.20 - $3.89.

Tuesday, December 11, 2012

Altair Nanotechnology To Execute 1:6 Stock Split

~70 million shares split 1:6 implies ~11.67 million shares post-split. The approximate float of 27.4 million shares shrinks to ~4.6 million shares. The $0.50 stock price becomes $3.00.

"We are continuing to build upon these recent successes and believe 2013 will bring much stronger financial performance. Maintaining our listing on the Nasdaq Capital Market is important to our current shareholders and should help us attract a broader range of investors to the company," said CEO Alexander Lee.

Monday, December 10, 2012

Red Hat: A Stock For 02013?

Thursday, December 6, 2012

Trimble Navigation Hits New 52-Week High

Wednesday, December 5, 2012

MedBox Added To GDT::WatchList

Thursday, November 29, 2012

Illumina Gets an Upgrade and a Downgrade

Tuesday, November 27, 2012

NeuroMetrix--Insider Buy Recorded

Monday, November 26, 2012

Yahoo! YHOO Hits a New 52-Week High

Facebook Gets a Buy Rating

Sunday, November 18, 2012

52-Week Lows: iRobot and Kratos; 52-Week High: Yahoo!

Kratos Defense & Security Solutions (KTOS) hit a new 52-week low last week Friday (02012.11.16) of $4.14. 52-week range: $4.14 - $7.79.

Yahoo! (YHOO) hit a new 52-week high last week Thursday (02012.11.15) of $18.16. YHOO closed the next day at $17.76 after hitting an intra-day high of $18.02. It appears as though Wall Street likes what Marissa Mayer is doing as CEO.

Geeknet and Nanosphere Keep Going Down

Nanosphere (NSPH) closed at $2.42 on Friday, 02012.11.16. The company has lost ~32% of its market value since hitting a new 52-week of $3.89 on 02012.08.28. Our NSPH is still above water, but that will stop being true if NSPH hits $2.25.

Sunday, November 11, 2012

Stewart Enterprises Stock is Dying, Yet the Company Lives

Elections Are Done; Fiscal Cliff Ahead?; Gridlock Good?

Cray (CRAY) reported 3Q'12 results prior to the market opening on Friday, 02012.11.09, and the stock spiked to a new 52-week high of $13.63. I sold some of our CRAY shares at $13.49. CRAY closed Friday, 02012.11.09, at $13.32.

I like Marc Andreessen and I agree with his assessment.

"A lot business people if you scratch below the surface, you'll find that we're basically antibipartisanship and pro-gridlock. And so I think if you're going to have a Democratic president, having a Republican House is a pretty good counterbalance to that. It's what we've been living with and I think we've been doing fine, and I think we'll live with that for the next four years." -- Marc Andreessen via BusinessInsider.com

Monday, November 5, 2012

Bruker Reports 3Q'12 Results and Raises Guidance

Frank Laukien, President and CEO of Bruker Corporation, commented: "Despite continued softening of demand in certain markets, we are pleased with our double-digit third quarter 2012 organic revenue growth rate, which in part benefitted from our still very significant backlog. Profitability also improved in the third quarter year-over-year. As a result of our third quarter performance, we are raising our full-year 2012 revenue guidance to a range of $1.73 - $1.76 billion, and we are raising our full-year adjusted EPS guidance to $0.75 - $0.79 per diluted share."

BRKR closed at $12.59 on 02012.11.02. 52-week range: $9.91 - $17.10.

Trimble Navigation Reports 3Q'12 Results

Sunday, November 4, 2012

Facebook; Level 3 Communications; StemCells; Stewart Enterprises

L-3 Communications (LLL) announced that its Security and Detection Systems division has been "awarded an indefinite-delivery/indefinite-quantity contract by the TSA to supply medium-speed explosives detection systems. This five-year acquisition program has a rev potential of $549.6 mln for L-3."

StemCells (STEM) announced it has partnered with R Biomedical to "develop and commercialize reagents for Human iPS Cell Research: The first product under the partnership, an 'ultra-primary' human fibroblast cell line from which researchers can generate iPS cell lines, was launched today under the SC Proven brand."

Stewart Enterprises (STEI) got a good review from Zachs Equity Research. "STEI is a good pick for investors seeking both growth and income, based on its solid third-quarter results, steady dividend yield and long-term earnings growth projection of 10.0%."Tuesday, October 30, 2012

Wall Street Remains Closed

Monday, October 29, 2012

Hurricane Sandy Closes Wall Street

Wednesday, October 24, 2012

iRobot, Illumina, Facebook Report 3Q'12 Results

IRBT closed yesterday at $22.64. 52-week range: $19.09 - $38.33. It's possible IRBT will hit a new 52-week low today (02012.10.24).

Illumina (ILMN) reported 3Q'12 results after the market closed yesterday (02012.10.23). From the company's press release. "We are very pleased with our operational execution so far in 2012," said Jay Flatley, Illumina's President and Chief Executive Officer. "As a result of our performance and the recent announcement regarding NIH funding under the continuing resolution, we are tightening our 2012 revenue and EPS guidance ranges. However, we remain cautious given the uncertainty of the U.S.fiscal cliff as well as the outcome of the Presidential election."

ILMN closed yesterday (02012.10.23) at $45.19. 52-week range: $25.65 - $55.39.

Facebook (FB) reported 3Q'12 results after the market closed yesterday (02012.10.23). Two observations: (1) Facebook ended the quarter with $10.5 billion in "cash." (2) Facebook's effective tax rate has been 40% for the first nine months of 02012.

FB closed yesterday (02012.10.23) at $19.50. 52-week range: $17.55 - $45.00. Pi moment on 02012.10.24... Pre-Market: $22.64 Up $3.14 (16.10%) 7:35AM EDT.

Monday, October 22, 2012

Yahoo! Reports 3Q'12 Results

"Yahoo! had a solid third quarter, and we are encouraged by the stabilization in search and display revenue," said Marissa Mayer, CEO of Yahoo!. "We’re taking important steps to position Yahoo! for long-term success, and we’re confident that our focus on quality and improving the user experience will drive increased value for our advertisers, partners and shareholders."

YHOO closed on 02012.10.22 at $15.77. 52-week range: $14.35 - $16.75.

I liked the following from Yahoo!'s 3Q'12 press release.

"Free cash flow was $920 million for the third quarter of 2012, a 273 percent increase compared to $247 million for the same period of 2011.""During the third quarter of 2012, Yahoo! repurchased 12 million shares for $190 million."

"In October 2012, Yahoo! entered into a 364-day, $750 million unsecured revolving credit facility. The facility is currently undrawn and is expected to be used for general corporate purposes."

[update::02012.10.23] YHOO hit a new 52-week high of $16.79 before closing at $16.77. Volume was 71.3 million vs. t3m-avg of 18.2 million. I guess Wall Street is thinking Mayer is off to a good start at Yahoo!'s CEO.

Friday, October 19, 2012

Google 3Q'12 Results Miss Expectations

GOOG closed on 02012.10.17 at $755.49. Yesterday (02012.10.18) GOOG hit an intra-day high of $759.42 before the 3Q'12 results were released early. GOOG plunged to $676.00 before closing at $695.00. For the day, GOOG was down 8%. Volume was 12.43 million vs. t3m-avg. of 2.77 million.

Here are my observations of the 3Q'12 results: free cash flow of $3.13 billion; capital expenditures were $872 million; "cash" at $45.7 billion; effective tax rate of 22%. From Google's press release: "Headcount – On a worldwide basis, we employed 53,546 full-time employees (36,118 in our Google business and 17,428 in our Motorola business) as of September 30, 2012, compared to 54,604 full-time employees as of June 30, 2012."

Thursday, October 18, 2012

IBM and Google

"IBM ended the third-quarter 2012 with $12.3 billion of cash on hand and generated free cash flow of $3.1 billion, excluding Global Financing receivables, down approximately $0.3 billion year over year. The company returned $4.0 billion to shareholders through $1.0 billion in dividends and $3.0 billion of share repurchases."IBM’s tax rate was 24.6%.

Google (GOOG) closed yesterday 02012.10.17 at $755.49. Google reports 3Q'12 results after the market closes today (02012.10.18).

Tuesday, October 16, 2012

Illumina; Level 3 Communications; StemCells

Illumina (ILMN) managed close up a few pennies after getting hit hard yesterday (02012.10.15). Yesterday, ILMN closed down 6% on volume that was 4.5x t3m avg.

Level 3 Communication (LVLT) closed at $22.82, up 5.6% for the day. Volume was average.

StemCells (STEM) closed at $2.40 today (02012.10.16), up 6.7%. The company "announced the launch of four new SC Proven human neural stem cell (NSC) kits for use in neuroscience research." I agree with this SeekingAlpha.com headline: "Nobel Prize Validates Recent Stem Cell Headlines". The GDT::Portfolio needs Aastrom Biosciences (ASTM) to stop falling.

Saturday, October 13, 2012

Alcatel-Lucent; Aastrom Biosciences; Google

Alcatel-Lucent (ALU) hit a new 52-week low of $0.91 on Thursday (02012.10.11). It's a bummer ALU is once again a penny stock (although it did end the week at $1.00).

Aastrom Biosciences (ASTM) hit a new 52-week low of $1.44 on Tuesday (02012.10.09) and this is a major bummer. ASTM's CEO is quitting, so the company is searching for a replacement. The company needs to attract somebody with a strong resume.

Google (GOOG) failed to hit any new highs this week, yet numerous investment firms have increased their GOOG target prices to the $850-$900 range. My initial target remains $2000. GOOG closed on Friday, 02012.10.12, at $744.75. 52-week range: $556.52 - $774.38.

Sunday, October 7, 2012

Aastrom Biosciences CEO Quits and ASTM Hits 52-Week Low

Tim M. Mayleben has decided to retire from his position as the company's president and chief executive officer once the company has hired his successor.

I don't know why Mr. Mayleben quit Aastrom Biosciences. Is this company a sinking ship?

Mayleben quoted in the company's press release.

I believe we have earned our leadership position in regenerative medicine and that this is a good time to bring in a new CEO to take Aastrom to the next level of clinical and commercial success.

Leap of faith time... I can only hope Mr. Mayleben is good at assessing what he can and cannot do and that he knows Aastrom has a hit a stage that is best managed by somebody else.

The new CEO that Aastrom Biosciences can attract will say a lot about the future of the company.

Thursday, October 4, 2012

Nanosphere is Getting Noticed

Both postings were bullish on NSPH."5 Stocks Under $10 Set to Soar" by StockPickr.com

"Long-Term BioTech Play at Motley Fool (Fool.com)"

Wednesday, October 3, 2012

Illumina Spikes Up

Sunday, September 30, 2012

Facebook: Cool or Not Cool?

"Is Facebook the Next MySpace?" by MotleyFool.com

"Will Facebook Become the Next E-Commerce Success?" by WallStCheatSheet.com

If only I knew because I don't think it can be both.

Saturday, September 29, 2012

3Q'12 Ends... Quickie GDT::Portfolio Top 10 Review

(1) Google (2) Cray (3) Geeknet (4) iRobot (5) Red Hat (6) Yahoo! (7) Nanosphere (8) Hanger (9) Illumina (10) Bruker

The GDT::Portfolio Top 10 one year ago at the end of 3Q'11 isn't that much different than it is now. Level 3 Communications was #10, but it's now #13. Nanosphere was #16 and now it's #7. Geeknet and Google were number #1 and #3, respectively, but now Google is #1 and Geeknet is #3. iRobot and Cray were number #2 and #4, respectively, but now iRobot is #4 and Cray is #2. Red Hat and Yahoo! remained unchanged at #5 and #6, respectively. Illumina dropped from #7 to #9 (insert Nanosphere at #7). Bruker dropped from #8 to #10. Hanger moved up from #9 to #8.

Thursday, September 27, 2012

Bought Aastrom Biosciences; StemCells Inc. Spikes Up

StemCells (STEM) spiked today after the company issued a press release having the following headline: "StemCells, Inc. Achieves Spinal Cord Injury Milestone With First Neural Stem Cell Transplant Into Patient With Sensory Function Below the Level of Injury". STEM closed yesterday (02012.09.26) at $1.93. Earlier today (02012.09.27) STEM hit $2.27. 52-week range: $0.59 - $2.67. With an hour left in trading, STEM volume was 10.1 million vs. trailing-3-month average of 2.6 million.

Wednesday, September 26, 2012

Google Turns 14 Tomorrow

Yesterday (02012.09.25) the state of California legalized self-driving cars.

Today I saw the following headline at AllThingsD.com. "Google Play’s 675,000 Apps Have Been Downloaded 25 Billion Times".

Google turns 14 tomorrow on 02012.09.27.

Monday, September 24, 2012

Red Hat Reports 2Q'13 Results

Operating cash flow was $103.9 million for the second quarter, as compared to $77.1 million in the year ago quarter. At quarter end, the company’s total deferred revenue balance was $944.4 million, an increase of 16% on a year-over-year basis. Total cash, cash equivalents and investments as of August 31, 2012 was $1.36 billion.

RHT closed today (02012.09.24) at $57.54. 52-week range: $37.85 - $62.75.

[02012.09.26] Quoting self: "Might be a tough day for RHT tomorrow." Today, 02012.09.26, the 'tomorrow' was yesterday and yesterday (02012.09.25) was a tough day. RHT closed at $55.08, down ~4.3%. Volume was 5M vs. t3m avg. of 3M.

Google (GOOG) Hits an All-Time High

MarketWatch.com reported that "Citigroup has raised its price target for Google GOOG to $850 from $740." I might consider selling some GOOG when it hits $2,000.

[02012.09.24] GOOG closed today (02012.09.24) at $749.38 after hitting an all-time high of $750.14. Volume was 3.56 million vs. trailing-3-month average of 2.31 million.

Sunday, September 23, 2012

New 52-Week Highs: Cray; Google; Hanger; Stewart Enterprises

Friday, September 21, 2012

Cray Spikes Up; Google Nears All-Time High

Google (GOOG) hit an intra-day high this morning of $734.50, which is less than 2% below its all-time high of $747.24 (hit on 02007.11.07). Yesterday (02012.09.20), Jim Cramer--who has a wide following--rated GOOG a buy. GOOG has stayed about $700 for six consecutive days.

Yesterday (02012.09.20) ended with CRAY and GOOG at #1 and #2, respectively, in the GDT::Portfolio. Cray: Supercomputing. Google: 21st century Informatics.

Thursday, September 20, 2012

Yahoo! Reduces Its Alibaba Holdings

"This outcome is terrific for Yahoo. It generates liquidity to create substantial value for our shareholders, while retaining a meaningful amount in the company to invest in our future. Also, because we still own 23 percent of Alibaba's common stock, we have the opportunity to benefit from future upside when Alibaba IPOs." -- Marissa Mayer, Yahoo! CEO

I like that Yahoo! still owns 23% of Alibaba's common stock because Alibaba is a China-based Internet company.

How this $3.65 billion is going to be passed onto shareholders as yet to be announced, but it does work out to ~$3.09 per YHOO share.

YHOO closed yesterday at $15.86. 52-week range: $13.11 - $16.79. The news of the Alibaba sale was not "good" enough news to propel YHOO to a new 52-week.

Nanosphere; iRobot; Google

"Nanosphere (NSPH): A Low-Risk, High-Growth Diagnostic Stock" via TheStreet.com

They lost me at "low-risk". NSPH closed yesterday (02012.09.19) at $3.50. 52-week range: $0.89 - $3.89

"Deal Costs To Hold Down iRobot" via SeekingAlpha.com

This appears to be the case. IRBT closed yesterday (02012.09.19) at $24.73. 52-week range: $19.09 - $38.33. iRobot acquired Evolution Robotics on 02012.09.17 and prior to the announcement IRBT was at $26.01. I like the deal.

"Red Hat Inc. Second Quarter Earnings Sneak Peek" via WallStCheatSheet.com

Today (02012.09.20) is Friday and Red Hat reports 2Q results next Monday on 02012.09.24. RHT closed yesterday (Thursday) at $57.58. 52-week range: $37.85 - $62.75. I'll sell some RHT at $67.48.

Tuesday, September 18, 2012

Bruker Sees Some Insider Buying

BRKR closed yesterday (02012.09.18) at $13.37. 52-week range: $9.91 - $17.10.

Geeknet Sells Slashdot, SourceForge, Freecode

From Geeknet's press release.

Ken Langone, Chairman of Geeknet, added, "We are very pleased to find a new home for our media business, providing a platform for the sites and our media teams to thrive. With this transaction completed, we will now focus our full attention on growing ThinkGeek."

GKNT closed yesterday (02012.09.17) at $18.46. 52-week range: $12.07 - $21.62.

[update::02012.09.18] GKNT closed at $19.09, up 3.4% for the day. Volume as just slightly above average.

Monday, September 17, 2012

iRobot Acquires Evolution Robotics

In 2010, ER launched Mint, an automatic floor cleaning robot designed exclusively for hard surface floors, which offers a different approach to cleaning than iRobot’s current products."

In addition, Paolo Pirjanian, CEO of Evolution Robotics, is becoming iRobot's Chief Technology Officer.

From my backseat driver perspective, this seems like a good move for iRobot.

IRBT closed on 02012.09.17 at $26.01. 52-week range: $19.09 - $38.33.

Friday, September 14, 2012

Apple, Amazon.com, Google, DJIA... Oh My

Apple (AAPL) is not a GDT::Portfolio stock, but it's nearing $700 a share while it continues to make new 52-week highs. Each new 52-week high is a new all-time high. At $696.03, Apple Inc. has an approximate market value of $652.06 billion.

Amazon.com (AMZN) is a GDT::Portfolio stock and it continues to hit new 52-week highs. Just like AAPL, for AMZN each new 52-week high is a new all-time.

Google (GOOG) is a GDT::Portfolio stock and it continues to hit new 52-week highs; however, these highs are not new all-time highs. Once Google hits a new 52-week high of $747.24 (it's all-time high that was hit on 02007.11.07), then for GOOG each new 52-week will be a new all-time high. Go GOOG!

DJIA all-time high is 14,198.10 and it was reached on 02007.10.11. The DJIA is at 13,609.24 on 02012.09.14 at 12:24pm ET. In other words, the DJIA is within 5% of its all-time high.

Illumina is Our Primary Genomics Investment

"Illumina Launches TruSightTM Targeted Sequencing Content Sets"

"Designed by recognized experts at leading institutions, the content sets offer cost-effective, streamlined, targeted sequencing for specific genetic diseases or conditions."

"Illumina Announces Expedited Individual Genome Sequencing Service (IGS)"

"Illumina has long believed that sequencing will become a mainstream practice in the clinical setting. By delivering a whole human genome in as little as two weeks, we have taken significant strides towards that goal," said Illumina President and CEO Jay Flatley.

"Illumina and Partners HealthCare Announce Alliance to Introduce Next-Generation Sequencing Clinical Interpretation and Reporting Tools"

"Illumina and Partners HealthCare share a vision of better patient care through genomics," said Matt Posard, Senior Vice President and General Manager of Illumina’s Translational and Consumer Genomics business. "This alliance highlights our commitment to a collaborative model that will establish the new standard in NGS clinical-based applications and enable a truly integrated, high-quality solution."

ILMN closed yesterday (02012.09.13) at $46.48. 52-week range: $25.57 - $55.39.

Thursday, September 13, 2012

Bought Some Altair Nanotechnologies

"Altairnano signed an agreement with Shenhua Science & Technology (Shenhua S&T) and its research affiliate, the National Institute of Clean and Low-carbon Energy (NICE), to jointly develop, deploy and promote industrial applications of lithium titanate-based energy storage systems in China."

The following is a quote from Altairnano's CEO Alexander Lee.

"Altairnano is pleased to work with a company like Shenhua, who concluded that our technology and knowledge of electric grid energy storage systems is well positioned to meet their aggressive growth targets. This agreement sets the foundation for rapid commercialization within China."

ALTI 52-week range: $0.40 - $1.48.

Red Hat Gets a 'Buy' Rating

[02012.09.13] Jim Cramer, some investment dude who is widely followed, was quoted saying Red Hat (RHT) "remains an inexpensive stock."

Wednesday, September 12, 2012

Yahoo! A Silicon Valley Peyton Place

Do you Yahoo!? Yes, I still do. But it has been extremely frustrating being a long-term YHOO shareholder.

Friday, September 7, 2012

Big Difference Between 4 Years and 3.5 Years

Rewind four years to 6 September 2008...

DJIA was 11,221 and is now 13,293, up 19%

NASDAQ was 2,261 and is now 3,136, up 37%

S&P 500 was 1,242 and is now 1,436, up 16%

Rewind 3.5 years to 9 March 02009...

DJIA was 6,470 and is now 13,293, up 105%

NASDAQ was 1266 and is now 3,136, up 148%

S&P 500 was 667 and is now 1,436, up 115%

Amazon.com; Google; Red Hat

Google (GOOG) hit yet another new 52-week high of $699.89 before closing yesterday (02012.09.06) at $699.40. GOOG's all-time high was $747.24 on 02007.11.07.

Red Hat (RHT) was #4 on Forbes Magazine's "The Ten Most Innovative Companies In America" rankings. RHT closed yesterday (02012.09.06) at $59.10. 52-week range: $36.61 - $62.75.

[update::02012.09.07] GOOG opened today at $700.00. Yes. According to Finance.Yahoo.com, GOOG opened today at exactly 700 bucks.

Thursday, September 6, 2012

Stewart Enterprises Ain't Dead Yet

"Generating operating cash flow of $30.3 million, or an increase of 22 percent, and free cash flow of $26.7 million, or an increase of 41 percent."

I also liked this...

"During the third quarter we repurchased 1 million shares of our common stock for an average price of $7.26 per share, resulting in a more than 5 percent decrease in total shares outstanding in the last twelve months. Over the last three years, we have increased our quarterly dividend by more than 60 percent, resulting in a return of approximately $36 million in dividends to our shareholders over the same time period. Even after the significant deployments of cash flow, our balance sheet and liquidity remain strong with $79 million in cash and marketable securities on hand with no amounts borrowed on our $150 million credit facility."

STEI closed yesterday (02012.09.05) at $7.61. 52-week range: $4.92 - $7.78.

[update::02012.09.06] A few minutes after I posted this I took a peek at STEI's SIR (Short Interest Ratio). Finance.Yahoo.com is reporting it being a whopping 45.3. 27% of STEI shares are closely held and "institutions" own 72% of the shares. STEI has to be above $10 before I consider selling any of our shares.

[update::02012.09.06 (after market closed)] STEI hit a new 52-week high of $8.38 before closing at $7.98, up almost 5% for the day. Volume was 1.23 million vs. trailing-3-month avg. of 0.3 million.

Tuesday, September 4, 2012

Is iRobot an Appliance Company?

iRobot (IRBT) ended August 02012 at #3 in the GDT::Portfolio, so it's an important stock for us. IRBT closed Friday, 02012.08.31, at $25.19. 52-week range: $19.09 - $38.33. IRBT's PSR (Price-Sales-Ratio) is 1.51, which I think is low; however, Whirlpool, which is not a GDT::Portfolio stock, has a PSR of 0.32.

StemCells Inc. Reports Good Stem Cells News?

"Today [02012.09.03] StemCells Inc. announced that interim six-month data from the first patient cohort in the Company's Phase I/II clinical trial of its proprietary HuCNS-SC(R) product candidate (purified human neural stem cells) for chronic spinal cord injury continues to demonstrate a favorable safety profile, and shows considerable gains in sensory function in two of the three patients compared to pre-transplant baselines. The third patient remains stable."

The company's press release included the following.

"To see this kind of change in patients who truly have the worst-of-the-worst type of injury to the spinal cord is very exciting. To our knowledge, this is the first time a sensory change of this magnitude has been reported in patients with complete spinal cord injury following a stem cell transplantation. We clearly need to collect more data to establish efficacy, but we are encouraged. We are pushing ahead with our trial and plan to dose the first patient with an incomplete injury soon."

STEM closed last week (Friday, 02012.08.31) at $2.17. 52-week range: $0.59 - $2.55.

[update::0212.09.04] STEM had quite a day. Previous close was $2.17; opened at $2.55; spiked to an intra-day high (and new 52-week high) of $2.67; closed at $2.20, up ~2.3% for the day. Volume was 13.7 million vs. trailing-3-month average of 1.9 million. 13.7 million shares is almost 50% of the float and 45% of all of the outstanding shares. Disclaimer: There is something about the STEM trading volume that I don't know about.

[update::0212.09.05] STEM closed at $2.13, down ~3.2%. Volume was 4.5 million. Intra-day low was $1.96. When it comes to STEM, volatility rules.

Saturday, September 1, 2012

Hanger Making New All-Times Highs?

The following are to graphs that go as far back as I go back using the free finance tools provided by Google and Yahoo!.

Friday, August 31, 2012

StemCells Previous Pop Lost, But STEM Pops Again

Two days ago STEM closed at $1.61. Yesterday it closed at $1.96 after hitting an intra-day high of $2.03. Yesterday's volume was 7.6 million compared to a trailing-3-month average of 1.7 million. Today (02012.08.31), at 8:12am MST, STEM is at $2.17. Volume is already at 5.8 million. STEM 52-week range: $0.59 - $2.55.

Headline seen this Friday morning by Thomson Reuters One: "PropThink: STEM Gains on Anticipation of Interim Trial Data to be Presented Monday"

Duh!

"Share price is likely to remain strong on Friday and into the meeting, as most analysts expect some positive results from the trial. If Monday`s data looks good for STEM, shares may climb higher on momentum, however, negative results will have disastrous effects on the stock. STEM is up 140% in 2012." -- PropThink.com

Again, duh!

[update::02012.08.31] STEM closed at $2.15 today (02012.08.31), up ~9.7% for the day. Intra-day high was $2.24. Volume was 9.8 million. I blogged about STEM volume back on the 26th of July.

Making New Highs: Amazon.com, Google, Hanger

It's around 8:00am MST on Friday, 02012.08.31. The following are some observations.

Amazon.com (AMZN) hit a new 52-week high of $250.00 yesterday (02012.08.30). Each new 52-week high is new all-time high.

Google (GOOG) is continuing to make new 52-week highs. Two days ago (02012.08.29) it hit a new 52-week high of $688.99.

Hanger (HGR) is continuing to make new 52-week highs. Today is the 3rd day in a row HGR has hit a new 52-week high.

Sunday, August 26, 2012

Amazon.com Hits an All-Time High

It appears AMZN started trading on 01997.05.16. It closed on its first day of trading at $1.73 (adjusted for splits: 2:1 on 01998.06.02; 3:1 on 01999.01.05; 2:1 on 01999.09.02). Great dot-com heyday example: In 01999, Amazon.com split their stock twice.

Friday, August 24, 2012

Geeknet; Yahoo!; Hanger

Earlier this week Geeknet announced that the president and CEO of ThinkGeek is quitting. I consider this opportunity for Geeknet to bring in a real geek to run ThinkGeek. I hope they take advantage of this opportunity, but right now it appears Wall Street is skeptical.

Wall Street also appears to be skeptical as to what Yahoo!'s new CEO is going to accomplish. Here's a headline I saw at the Motley Fool today: "Yahoo Takes on the World: $4 Billion War Chest and a New CEO".

Hanger (HGR) is one stock that I've never sensed any frustration with. Today (02012.08.24) some firm named Stephens initiate HGR coverage with an 'Overweight' rating. There target price is $35. HGR closed yesterday at $26.87. 52-week range: $14.57 - $27.90. HGR hit the $27.90 52-week high three days ago on 02012.08.21.

Thursday, August 23, 2012

StemCells Gets a 'Buy' Rating

NeuroMetrix Has Some Insider Buying

Tuesday, August 21, 2012

52-Week Lows and Highs on 02012.08.20

Facebook (FB) hit a new 52-week low of $18.75 yesterday (02012.08.20) before closing at $20.01.

Google (GOOG) hit a new 52-week high of $678.87 yesterday (02012.08.20) before closing at $675.54.

Hanger (HGR) hit a new 52-week high of $27.48 yesterday (02012.08.20) before closing at $27.36.

Nanosphere (NSPH) hit a new 52-week high of $3.68 yesterday (02012.08.20) before closing at $3.60.

Saturday, August 18, 2012

Comparing Apple, Google and Facebook

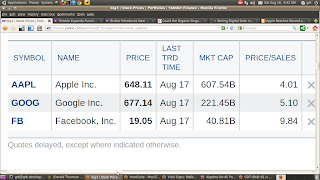

Google (GOOG) hit a new 52-week high of $677.25 yesterday (02012.08.17) before closing at $677.14. Google's market value was ~$221.45 billion. GOOG's all-time high is $747.24 and it was hit on 02007.11.07. Google went public on 19 August 02004.

Facebook (FB) hit a new all-time low of $19.00 yesterday (02012.08.17) before closing at $19.05. Facebook's market value was ~$40.81 billion. FB's all-time high is $45.00 and it was hit on 02012.08.14. Facebook went public on 18 May 02012.

[update::02012.08.19]

I'm creating some math fodder using my version of the Big Three. Here's some numbers for those of you who like numbers. In the span of 28 years (01984-02012) Apple Inc. stock has increased 21,458%. In the span of 8 years (02004-02012) Google Inc. stock has increased 697%. In the span of 3 months (5/18-8/18 of 02012) Facebook Inc. stock has decreased 50%. #JustNumbers

There's something about Apple Inc. having a market value of $607,540,000,000 that I find interesting. Apple Inc.'s market value is only seven percent less than the combined market values of Exxon Mobil and Wal-Mart. Apple Inc.'s market value is 24% greater than the combined market values of IBM and Microsoft.

Friday, August 17, 2012

Bought More Facebook; Google Up; Taxing Capital Gains

Google (GOOG) hit a new 52-week high of $674.64 yesterday (02012.08.16) before closing at $672.87.

Op-Ed from the New York Times: "Should We Stop Taxing Capital Gains?" My response: Yes and no. Set the tax rate to 0% for long-term (5 years? 10 years?) capital gains, but increase the tax rates as holding periods decrease.

Wednesday, August 15, 2012

George Soros Likes Facebook?

Our FB investment is underwater. I continue to have good-till-cancel order open to buy some FB at 6-Pi dollars (i.e. $18.85). FB was at $20.85 at 11:19PM MST on 02012.08.15.

Google Hits New 52-Week High

Wall Street liked the news that Google was reducing its workforce, which needed to be done after it acquired Motorola Mobility.

Tuesday, August 14, 2012

Andy Kessler is an E.F. Hutton To Me

"[the] move from a Dow Jones closing at 777 on August 12, 1982 through 13,161 today is an era defining trend." -- Andy Kessler

I agree with Kessler when he says, "Printing money doesn’t drive markets, productive ideas do."

Thursday, August 9, 2012

Aastrom Biosciences Hits New 52-Week Low

I will highlight one near-term unfortunate aspect of the warrant exchange is that it has put some near-term downward pressure on our stock as many of these shares are sold by, again, these warrant holders, which I think we all know to be very short-term oriented and so we think they are finding their way into longer-term investor hands, but again, the transition, this movement of these shares from the warrant holders, which tend to be much more short-term focused and not fundamental focused and into longer term more stable hands is a process.

ASTM close yesterday at $1.74. 52-week range: $1.74 - $2.91.

[update::02012.08.09] Added to our ASTM holdings. Buy price was $1.75.

Monday, August 6, 2012

NeuroMetrix Pops?

TheFlyOnTheWall.com reported "NeuroMetrix receives 510(k) premarket notification for pain relief device".

I'll probably edit (update) this posting when I learn more.

[02012.08.06] Via Briefing.com: NeuroMetrix "confirmed that is has received 510(k) clearance for its SENSUS Pain Management device from the FDA." NURO closed today at $0.80, up 23% for the day. Intra-day high was $0.85. Volume, at 990,472 shares, was almost 16-times the trailing-3-month average and ~8% of the float.

Sunday, August 5, 2012

LookSmart Reports 2Q'12 Results and Says No To PEEK

"Our Board unanimously believes that PEEK's unsolicited offer is financially inadequate, fails to capture the value of LookSmart's market positioning and growth opportunities, and is not in the best interests of LookSmart stockholders," said Dr. Jean-Yves Dexmier, Executive Chairman and Chief Executive Officer of LookSmart.

LOOK closed at $0.90 on Thursday, 02012.08.02. LOOK rejected PEEK's offer and reported 2Q'12 results after the market closed. On Friday, 02012.08.03, LOOK hit an intra-day low of $0.76, before closing at $0.83.

About LookSmart's 2Q'12 results... "The Company ended the quarter with $20.2 million in cash, cash equivalents, and investments, compared to $24.8 million at December 31, 2011." The company has approximately $1.17 per LOOK share in cash.

Friday, August 3, 2012

Automated Trading Systems Are Scary

Building error-free trading software is impossible, and that makes today's stock markets even more fragile. -- Fortune Magazine's FacebookFinance.Fortune.CNN.com:: Why Knight won't be the only one

Thursday, August 2, 2012

Amazon.com and the Future

AMZN closed yesterday (02012.08.01) at $232.09. 52-week range: $166.97 - $246.71. Note: the 52-week high is also the all-time high.

AMZN closed at $1.73 (adjusted for splits) on its first day of trading on 16 May 01997. In other words, in the span of 15 years AMZN has increased approximately 13,315.6%. {Chart}

Wednesday, August 1, 2012

Cray Reports 2Q'12 Results and CRAY Dumps

I liked the following.

"The big news of the -- for the quarter was our first ever petascale supercomputer installed on a large commercial customer."

CRAY closed at $12.43 yesterday (02012.07.31). 52-week range: $4.96 - $12.93.

[update::02012.08.02] CRAY closed at $11.37 yesterday (02012.08.01), down ~9.6% for the day. Multiple sources reported the following: "A short-sale restriction was triggered in trading of Cray's stock on the Nasdaq OMX earlier in the session."

Tuesday, July 31, 2012

Aastrom Biosciences: Warrants Exercised and an Upgrade

"We are extremely pleased with the results of the exchange, which has improved the company's capital structure, removed most of these complex and dilutive warrants, and reduced the number of fully diluted Aastrom shares by more than six percent. We are now in a much better position to continue to attract high-quality, long-term investors to Aastrom who will no longer have to be concerned about the potential future impact of these warrants," said Tim Mayleben, Aastrom's president and chief executive officer.

The warrant count is not zero. From the press release: "There now remain 308,100 December 2010 warrants outstanding with an exercise price of $3.22 and an expiration date of December 15, 2015."

I don't know anything about WBB Securities, but they like ASTM.

02011.02.09... initiated coverage: Sell

02011.12.06... upgraded rating to: Hold

02012.04.16... upgraded rating to: Speculative Buy

02012.06.04... upgraded rating to: Buy

02012.07.24... upgraded rating to: Strong Buy

ASTM closed yesterday (02012.07.30) at $1.96. 52-week range: $1.75 - $2.91.

Monday, July 30, 2012

High Short-Interest-Ratio GDT::Portfolio Stocks

Stewart Enterprises (STEI): 29.00 SIR at $6.80

Illumina (ILMN): 24.80 SIR at $42.30

Altair Nanotechnologies (ALTI): 17.30 SIR at $0.47

Aastrom Biosciences (ASTM): 14.00 SIR at $2.00

Kratos Defense & Security Solutions (KTOS): 13.40 SIR at $5.70

iRobot (IRBT): 12.50 SIR at $24.63

Level 3 Communications (LVLT): 11.90 SIR at $18.70

Geeknet (GKNT): 9.70 SIR at $19.73

Friday, July 27, 2012

Facebook Reports 2Q'12 Results

Reuters headline from this morning: Facebook shares down on lack of financial outlook.

Hmm... I consider this good news. In a nutshell, Facebook might be taking a long-term view of their business.

TheStreet.com headline from this morning: Facebook Proves It Stinks to Be a Long-Term Investor.

I agree! It has sucked being a long-term investor here in the 21st century.

Forbes.com headline from this morning: Six Reasons Facebook is a $7 Stock

This morning I placed an order to add to our FB holdings. The buy price is $21.99, so it won't surprise me if today's intra-day low is $22.00. [Why $21.99? Multiply Pi by seven and round to the nearest penny.]

FYI... Facebook ended 2Q'12 with $10.2 billion in "cash".

Investor.FB.com::Facebook Reports Second Quarter 2012 Results

Thursday, July 26, 2012

StemCells Volume Has Been Interesting

[02012.07.27] ~3.5M STEM shares traded yesterday (02012.07.26). That's approximately 15% of the float. STEM closed at $1.78, down 15+% for the day. Prior the market opening today (02012.07.27), StemCells Inc. announced the following.

"The California Institute for Regenerative Medicine has approved an award to the Company [StemCells Inc.] and its collaborators for up to $20 mln under CIRM's Disease Team Therapy Development Award program. The award is to fund preclinical development of co's proprietary HuCNS-SC product candidate as a potential treatment for cervical spinal cord injury."

My guess is today will be yet another high volume day.

Wednesday, July 25, 2012

Illumina; iRobot; Level 3 Communications

iRobot (IRBT) reported 2Q'12 results after the market closed yesterday (02012.07.24). IRBT hit a new 52-week low of $19.09 yesterday before closing at $19.49. 52-week range: $19.09 - $38.33. In a nutshell: Home robot business doing great. Military robot business struggling. iRobot is expanding its Healthcare robot business.

Level 3 Communications (LVLT) reported 2Q'12 results prior the market opening today (02012.07.25). LVLT closed yesterday (02012.07.24) at $20.42. 52-week range: $16.51 - $36.00. From the press release: "We continue to expect to generate positive Free Cash Flow for the second through fourth quarters of 2012, in the aggregate."

Tuesday, July 24, 2012

Yahoo!; StemCells; Nanosphere; Google

Yahoo! (YHOO) issued an important press release on Monday (02012.07.16): Yahoo! Appoints Marissa Mayer Chief Executive Officer. I found this announcement a pleasant surprise. Mayer was employee number 20 at Google. On the next day (02012.07.17) Yahoo! reported 2Q'12 results and here are two notes: (1) "Cash, cash equivalents, and investments in marketable debt securities were $2,401 million at June 30, 2012 compared to $2,530 million at December 31, 2011, a decrease of $129 million." (2) "During the second quarter of 2012, Yahoo! repurchased 30 million shares for $456 million."

StemCells (STEM) had quite a day last Tuesday (02012.07.17). STEM closed the previous day at $0.87 and on Tuesday it closed at $1.80. Trading volume was 16.9 million. Yesterday (02012.07.23), STEM hit an intra-day high of $2.26 before closing at $1.89. Trading volume remains heavy. Here's the why... StemCells, Inc. Announces Its Human Neural Stem Cells Restore Memory in Models of Alzheimer's Disease

Nanosphere (NSPH) director Mark Slezak added to his NSPH holdings buying one million shares (indirectly) at $2.40 per share on Wednesday (02012.07.18).

Google (GOOG) reported 2Q'12 results on Thursday, 02012.07.19, and they were good. My take: $3.48 billion free cash flow; $43.1 "cash"; 54,604/34,311 Googlers (includes 20,000+ from Motorola Mobile); $774 million in capital expenditures; 19% effective tax rate. GOOG closed up 2% on the release of the 2Q'12 results.

Thursday, July 12, 2012

Nanosphere Gets Another 'Buy' Rating

On Monday, 02012.07.09, I sold some Nanosphere (NSPH) at $3.50. It was a limit order that I didn't expect to hit, but it did. I found out today that also on Monday Nanosphere was "upgraded to Buy from Neutral at Roth Capital."

NSPH closed last week (02012.07.06) at $3.19. It opened this week (02012.07.09) at $3.40 and it spiked to $3.57 before closing at $3.41. The next day (02012.07.10) it closed at $3.12 and yesterday (02012.07.11) it closed at $3.00.

Thursday, July 5, 2012

Stewart Enterprises Gets a 'Buy' Rating

+ Cemetery Stock Stewart Enterprises Back From the Dead (Minyanville)

+ Stewart Enterprises initiated with a Buy at UBS (theflyonthewall.com)

With respect to the Minyanville headline: I didn't know that Stewart Enterprises had been "dead."

STEI closed on 02012.07.03 at $7.40. 52-week range: $4.92 - $7.88.

There are approximately 86,720,000 STEI shares. The following is data mined from Yahoo! Finance.

+ % of Shares Held by All Insider and 5% Owners: 27%

+ % of Shares Held by Institutional & Mutual Fund Owners: 72%

+ % of Float Held by Institutional & Mutual Fund Owners: 99%

STEI short-interest-ratio is at ~29.2.

Tuesday, July 3, 2012

Sold Some Cray (CRAY)

Nanosphere Gets a 'Buy' Rating

Monday, July 2, 2012

Spire At Risk of Being Delisted

On 27 June 2012, received a notice from NASDAQ saying they are violation of the "minimum value" rules again.

SPIR closed on 02012.06.29 at $0.60 (well below a buck) giving Spire Corp. a market value of ~$5.09 million (well below $15 million).

SPIR has a grocery store-like PSR (Price Sales Ratio) of 0.1.

There are ~8.56 million shares outstanding with ~26.31% closely held giving SPIR a thin float of ~6.23 million.

SPIR 52-week range on 02012.07.01: $0.38 - $2.66.

Spire reported 1Q'12 results on 02012.05.10 (i.e. almost two months ago)."We anticipate the softness in the solar industry to continue for a while longer. However, the bottom in equipment spending is expected to occur sometime toward the end of 2012, as manufacturers begin capital improvement programs including equipment updates and expansion. Market researchers predict a return to double digit growth sometime in 2013 that would extend for at least the next several fiscal years. We are positioned to capitalize on this projected growth with the recent introduction of our newest simulator, the Spi-Sun SimulatorTM 5600SLP and new Spi-AssemblerTM 8000. We are also combining our solar product lines by offering systems capabilities to our manufacturing line customers."

Spire is in a tough spot because implementing a reverse stock split does not do anything to change the company's market value.

LookSmart Worth More Than a Buck Per Share

[update::02012.07.02] LOOK closed at $0.89, up ~22% for the day. Intra-day high was $0.95. Volume was almost 10-times the trailing-3-month average.

Sunday, July 1, 2012

GDT::Portfolio End of 2Q'12 Review

Top 10 (Tier One)

(1) Cray [supercomputing]; (2) Geeknet [ecommerce]; (3) Google [Informatics]; (4) iRobot [robotics]; (5) Red Hat [open source]; (6) Yahoo! [Informatics]; (7) Hanger [healthcare]; (8) US Airways [transportation]; (9) Illumina [genomics]; (10) Bruker [scientific equipment].

Red Hat, Hanger, and US Airways should be in Tier Three. Yahoo! should be mid-Tier Two.

Tier Two

(11) Nanosphere [molecular diagnostics]; (12) Level 3 Communications [Internet pipe]; (13) Stewart Enterprises [deathcare]; (14) Amazon.com [ecommerce]/Informatics]; (15) Aastrom Biosciences [stem cells]; (16) Trimble Navigation [positioning systems]; (17) iParty [retail]; (18) Comcast [communications/media]; (19) LookSmart [Informatics; (20) Axion Power [batteries]

Stewart Enterprises, Amazon.com, Comcast, and Trimble Navigation should be Tier Three stocks. Nanosphere and Aastrom Biosciences need to be in Tier One.

Tier Three

(21) Spire [solar]; (22) Kratos Defense & Security Solutions [government security systems]; (23) Mace Security [security products]; (24) NeuroMetrix [diabetes diagnostics]; (25) Facebook [Informatics]; (26) AT&T [telecommunications]; (27) Altair Nanotechnologies [batteries]; (28) StemCells [stem cells]; (29) Lucent-Alcatel [telecommunications]; (30) Digital Angel [RFID]; (31) Isotechnika [biopharmaceuticals]

Spire needs to be in the Top 10. Altair Nanotechnologies, StemCells, and NeuroMetrix should be in the Top 15. Digital Angel is going to be removed from the portfolio before this year is over.

Friday, June 29, 2012

2Q'12 Ends Today

I'm disappointed that Nanosphere (NSPH) didn't make a new 52-week high yesterday (02012.06.28), but I was glad to see the stock hold onto recent gains on heavy volume.

It's nice to see Stewart Enterprises (STEI) above $7. Right now (7:04am MST on 02012.06.29) STEI is at $7.07. 52-week range: $4.92 - $7.88.

Hanger (HGR) is less that 2% from a new 52-week high.

Cray (CRAY) hit a new 52-week high of $12.24 today (02012.06.29). My order to sell some CRAY at $12.57 is still in the system.

Thursday, June 28, 2012

I Like New 52-Week Highs, But...

Let's use iParty (IPT) as an example. In one month, IPT's 52-week will drop from $0.28 to ~$0.20. Right now (7:00am MST on 02012.06.28) IPT is at $0.22.

Wednesday, June 27, 2012

Nanosphere Pops

[update::02012.06.28] NSPH closed yesterday (02012.06.27) at $2.32. Intra-day high of $2.55 was also a new 52-week high. Volume was 3.88 million compared to a trailing-3-month average volume of 0.22 million.

Thursday, June 21, 2012

Axion Power Intl.: Added to Our AXPW Holdings

Today (02012.06.21) I added to our Axion holdings by buying AXPW shares at $0.35. One month ago I bought some AXPW at $0.39.

Our AXPW holdings are undewater, but they are little less underwater given today's purchase.

Wednesday, June 20, 2012

Red Hat Reports 1Q'13 Results

$56.50 Down $0.42 (down 0.74%) 4:00PM EDT

After Hours: $50.00 Down $6.50 (down 11.50%) 4:31PM EDT

Needless to say, without looking at the 1Q'13 results, it appears as though Red Hat did not exceed exceeded expectations.

My observations about 1Q'13 results...

"Operating cash flow was $124.4 million for the first quarter, as compared to $90.2 million in the year ago quarter."

"Total cash, cash equivalents and investments as of May 31, 2012 was $1.3 billion after repurchasing approximately $30 million, or approximately 550,000 shares, of common stock in the first quarter."

Red Hat believes FY 02013 has gotten off to a good start and I agree.

RHT closed today (02012.06.20) at $56.60. 52-week range: $31.77 - $62.75.

CRAY Hits New 52-Week High

Historically, CRAY's all-time high (I think) was on 2 September 01997 when it hit ~$72.76. CRAY's most recent high was ~$55.96 on 10 September 02003. Five years later, 12 November 02008, it reached its all-time low of $1.15.

[update::02012.06.20] CRAY made a new 52-week high of $12.12 today before closing at $11.92.

Tuesday, June 19, 2012

Geeknet: Insiders Bought This Month (June)

http://www.nasdaq.com/symbol/gknt/insider-trades

Hmm... I guess it may be possible insiders are planning on taking this company private.

GKNT closed yesterday at $18.00. 52-week range: $12.07 - $27.85.

Rewind to 27 May 02012... Geeknet (GKNT) had some insider buying this [May] month. Yesterday (02012.05.26) GKNT closed at $16.47. 52-week range: $12.07 - $30.23. The insider buying took place between May 14th and May 23rd at prices ranging from $14.45 and $14.86.

Monday, June 18, 2012

Cray Gets a 'Buy' Rating

Cray (NASDAQ:CRAY): Needham reiterated its rating of Buy for this company and changed its price target from $12 to $14.

CRAY closed Friday (02012.06.15) at $11.54. 52-week range: $4.96 - $11.87.

I'd like to see CRAY at $14 because I have an order to sell some CRAY at $12.57 ($4 Pi).

Yahoo!; Google; Mace Security

Google (GOOG)... The company needs to do something to get GOOG shares moving upward. I continue to believe Google has a bloated workforce, so I'd like to see the company reduce the number of Googlers it has on the payroll.

Mace (MACE)... MACE showed signs of life on Friday (02012.06.15) when it closed at $0.25 on heavy volume, but today (02012.06.18) the stock is down a couple pennies.

A popular acronym these days... PIGS (Portugal, Ireland, Greece, Spain).

Friday, June 15, 2012

Stewart Enterprises is Not Dead Yet

"For the second quarter of 2012, we generated the highest quarterly revenue, gross profit and adjusted earnings per share in four years."Sounds good to me! I also liked the following highlight from 2Q'12: "operating and free cash flow of $20.7 million and $16.8 million, respectively."

The 2Q'12 press release ended with the following.

"Over the last two and a half years, the Board has increased our dividend by 60 percent, which reflects its commitment to returning capital to our shareholders through the payment of dividends and its continued confidence in the Company's financial condition and our ability to consistently generate cash flow."

I guess many investors do not believe Stewart Enterprises can sustain this performance.

STEI closed yesterday (02012.06.14) at $6.67. 52-week range: $4.92 - $7.88. Current SIR is 34.8.

Monday, June 11, 2012

Nanosphere; Cray, Aastrom Biosciences; Hanger

[item] Top Buys by Directors: Slezak's $289.2K Bet on NSPH - Forbes http://onforb.es/LujBkb via @sharethis

Nanosphere (NSPH) closed Friday, 02012.06.08, at $1.97 putting NSPH at #10 in the GDT::Portfolio.

[item] Cray (CRAY) hit a new 52-week high of $11.50 on Friday, 02012.06.08.

[item] Aastrom Biosciences (ASTM) continues to report what I think is good news. From Wednesday, 02012.06.08: Ixmyelocel-T Shown to Protect Heart From Damage in Murine Model of Heart Failure - Yahoo! Finance http://finance.yahoo.com/news/ixmyelocel-t-shown-protect-heart-220000784.html via @YahooFinance

Aastrom Biosciences (ASTM) closed Friday, 02012.06.08, at $2.26. One week earlier it closed at $1.96.

[item] Hanger (HGR) shareholders approved the company changing its name from Hanger Orthopedics to Hanger Inc.

Monday, June 4, 2012

LookSmart To Buyback LOOK Shares

Saturday, June 2, 2012

iRobot Hits New 52-Week Low

Speaking of yesterday... uglier than ugly. DJIA down 2.22%; NASDAQ down 2.82%; S&P 500 down 2.46%.

Thursday, May 31, 2012

iParty to Execute a Reverse Stock Split?

This is the third time this month I blogged about iParty...

[02012.05.04] iParty (IPT) closed at $0.21 yesterday (02012.05.03). Today is down a penny at $0.20. Interesting news story involving an iParty store. iParty defends offensive favors. Some IPT insider buying has taken place at $0.19. The dollar amounts invested were small, but they were insider buys nonetheless.

[02012.05.02] iParty (IPT) reported decent 1Q'12 results last week on 02012.04.25. Now IPT shares seems are near $0.20, which appears to be a resistance price. If IPT can move above two dimes, then a move to three dimes could happen quickly. $0.29 is the 52-week high. When it comes to historical pricing, Finance.Yahoo.com for IPT goes back to 30 December 01999 when it opened at $3.72. I think the last time IPT closed above a buck was when it closed at $1.01 on 26 April 02004 (i.e. 8 years ago).

Sunday, May 27, 2012

Geeknet: Insiders Bought This Month (May)

Friday, May 25, 2012

US Airways Hits New 52-Week High

Tuesday, May 22, 2012

Facebook: Added to Our FB Holdings

Monday, May 21, 2012

Facebook Drops Well Below IPO Price

Interesting tidbit... On 21 May 02012, Google (GOOG) has remained above its IPO price for 2,832 consecutive days, but Facebook (FB) could do it for only one day.

Friday, May 18, 2012

Facebook Added To the GDT::Portfolio

I decided to buy some FB after experience a Facebook $Pi moment...

Wednesday, May 16, 2012

Axion Power Intl.: Added to Our AXPW Holdings

"I have previously mentioned that the road to PbC commercialization has been longer than we anticipated, but that we were finding the market opportunities, for our PbC product applications, larger and more diverse than we had initially anticipated." -- Axion CEO Thomas Granville

Another tidbit from the 1Q'12 press release.

"We have received numerous new requests for proposals and quotations, more than half of which have come from new markets for our product. And although these are new opportunities in new markets, it is the historical advantage of PbC batteries that makes the equation work."

And I believe it's possible the Axion "equation" does "work."

AXPW fell a nickel after 1Q'12 results were reported and closed yesterday (02012.05.15) down four cents at $0.38. 52-week range: $0.25 - $0.84.

Tuesday, May 15, 2012

Science from Scientists; Facebook Going Public

[item] Facebook is going public on Friday (02012.05.18) of this week. The company has increased the size of its IPO. Initial share price will be in the $34 - $38 range. The number of shares was increased by 50.6 million to ~388 million. Facebook Inc.'s IPO might raise $14.75 billion.

Monday, May 14, 2012

Yahoo! Gets Yet Another New CEO; LCC to $18?

US Airways (LCC) made a new 52-week high of $11.47 on Friday (02012.05.11) before closing at $11.32. TheFlyOnTheWall.com reported that was "upgraded to Buy from Neutral at Sterne Agee". Sterne Agee's target price was $18. That'd be nice. I have plans to sell some LCC at $12.57 ($4Pi).

Saturday, May 12, 2012

Geeknet and Spire Show Signs of Life

"In making the announcement, the Company stated there can be no assurance that the exploration of strategic alternatives will result in any transaction. The Company undertakes no obligation to make any further announcements regarding the exploration of strategic alternatives unless and until a final decision is made."

GKNT closed at $15.03 on Friday, 02012,05.11, up 14.2% for the day. Trading volume was only 64,537 shares.

Spire (SPIR) reported 1Q'12 results prior to the market opening on Friday, 02012.05.11. From the company's press release.

“We anticipate the softness in the solar industry to continue for a while longer. However, the bottom in equipment spending is expected to occur sometime toward the end of 2012, as manufacturers begin capital improvement programs including equipment updates and expansion. Market researchers predict a return to double digit growth sometime in 2013 that would extend for at least the next several fiscal years." -- CEO Roger Little

SPIR closed on 02012.05.11 at $1.03, up 13.2% for the day. Volume was only 27,940 shares.

Friday, May 11, 2012

STEM at $0.911

StemCells (STEM) closed at $0.911... STEM has been a "call 911" investment for us. Company burns cash. It has stem cells, but Wall Street doesn't seem to give them much value.

StemCells reported 1Q'12 results yesterday (02012.05.10) after the markets closed. Say what?

"We have now established proof of principle that our cells are capable of myelinating nerve axons in an appropriate, progressive and durable way in the brains of patients with a severe myelination disorder." -- StemCells Inc.

Wednesday, May 9, 2012

Kratos Buying a Drone Maker

The details are plentiful... KratosDefense.com::Kratos to Acquire Leading Composite Manufacturer and Aerial Target Systems Provider Composite Engineering, Inc.

KTOS closed yesterday (02012.05.08) at $4.77. 52-week range: $4.61 - $13.47.

Friday, May 4, 2012

Geeknet; US Airways; iParty (I wish)

iParty (IPT) closed at $0.21 yesterday (02012.05.03). Today is down a penny at $0.20. Interesting news story involving an iParty store. iParty defends offensive favors.

Some IPT insider buying has taken place at $0.19. The dollar amounts invested were small, but they were insider buys nonetheless.

Thursday, May 3, 2012

1Q'12 Results: Geeknet, Hanger, Level 3 Communications

Hanger (HGR) reported 1Q'12 results after the market closed yesterday (02012.05.02). I liked reading this: "The Company's cash flow from operations increased $13.6 million to $1.3 million during the quarter ended March 31, 2012, compared to a use of $12.3 million for the first quarter of 2011." More the press release: "We are very pleased with the strength of this performance and remain confident in achieving our full year guidance. Never the less, we expect the regulatory and reimbursement environment to remain challenging though the remainder of 2012." From my seat in coach I can see that "never the less" being "challenging." HGR closed yesterday (02012.05.02) at $23.29. 52-week range: $14.57 - $27.90.

Level 3 Communications (LVLT) reported 1Q'12 results prior to the market opening today (02012.05.03). From the Level 3 press release: "In the aggregate for the remaining three quarters of 2012, we expect Free Cash Flow to be positive. We continue to have confidence in our outlook for this year, and expect to grow the business for the remainder of 2012." LVLT closed yesterday (02012.05.02) at $24.26. 52-week range: $16.51 - $40.05.

Wednesday, May 2, 2012

AMZN (Amazon.com) Hit $200 One Year Ago Today

One year ago today I tweeted the following.

Amazon.com (AMZN) closed on its first day of trading on 01997.05.16 at an adjusted price of $1.73 ($20.75 prior to 2:1 split on 01998.06.02; 3:1 split on 01999.01.05; 2:1 split on 01999.09.02). 5099 days later (i.e. 13 years, 11 months, 16 days) AMZN hit $200 and I captured the moment using Google Finance.

Right now (9:00am MST on 02012.05.02) AMZN is at $230.06. AMZN is up ~13,198.3% in the span of ~15 years.

iRobot; LookSmart (yeah right); iParty

LookSmart (LOOK) reported 1Q'12 results after the market closed yesterday (02012.05.01). The company ended the quarter with cash per share of ~$1.30. LOOK closed yesterday at $0.95. 52-week range: $0.91 - $1.96.

iParty (IPT) reported decent 1Q'12 results last week on 02012.04.25. Now IPT shares seems are near $0.20, which appears to be a resistance price. If IPT can move above two dimes, then a move to three dimes could happen quickly. $0.29 is the 52-week high. When it comes to historical pricing, Finance.Yahoo.com for IPT goes back to 30 December 01999 when it opened at $3.72. I think the last time IPT closed above a buck was when it closed at $1.01 on 26 April 02004 (i.e. 8 years ago).

Tuesday, May 1, 2012

Need To Be a Geek To Understand Geeknet?

In preparing this posting I came across something that I posted a year ago. From Geeknet's 1Q'11 conference call. In a nutshell... (a) Kenneth Langone made a point to remind us that he (and two others) control 35+% of the stock, so they have a vested interest in the company. (b) He considers the company's "runway" of opportunities to be "limitless" but the company needs to execute. (c) He considers his management team to be one of the strongest he has ever had (he co-founded Home Depot).

Geeknet reports 1Q'12 results on May 3rd.

Back on Pi Day 02012, The Benchmark Company initiated coverage on GKNT with a 'Buy' rating. GKNT closed at $15.10 on 02012.03.13 (the day before Pi Day 02012).

On 02012.05.01, at it's current price of $13.76, GKNT has a PSR (Price Sales Ratio) of 0.78.

Bruker Reports 1Q'12 Results

Frank Laukien, Bruker’s President and CEO, commented: “We are pleased with our first quarter 2012 results, as we delivered 13.7% organic revenue growth, along with double-digit growth in operating income and net income year-over-year. Our backlog continued to grow even further due to excellent first quarter 2012 orders. The tone in many of our end markets has improved since the fourth quarter of 2011, and our focus on new products and innovative solutions for major secular trends in the life and materials sciences and related industries is resulting in excellent, profitable organic growth.”

I also liked this... "For the first quarter of 2012, Bruker’s cash flow provided by operations was $4.8 million, compared to cash used in operations of ($29.4) million in the first quarter of 2011."

BRKR closed yesterday (02012.04.30) at $15.03.

Monday, April 30, 2012

Nanosphere... Good News?

"We are excited to be working with the Nanosphere team to bring these innovative molecular diagnostic products to our customers for the first time. Together with our existing range of Thermo Scientific microbiology products, they provide a comprehensive solution to diagnosis of serious infectious disease." -- Thermo Fisher

Thermo Fisher Scientific does roughly $12 billion per year in revenue and has an approximate $20 billion market value. Nanosphere's market value is currently $73 million.

Nanosphere (NSPH) releases 1Q'12 results tomorrow (02012.05.01).

[update::02012.05.01] NSPH closed yesterday at $1.78, up 6.6% for the day. Trading volume was light.

[update::02012.05.01] Nanosphere released 1Q'12 results prior to the market opening today. 1Q'12 revenues were double those for 1Q'11 and these days Nanophere needs to generate some revenue. The company ended the quarter with ~$0.73 per share in cash. The number of shares outstanding at the end of 1Q'12 was ~58% higher than at the end of 1Q'11. Again, NSPH closed yesterday at $1.78.

"Our business has achieved an inflection point with new customer placements that will drive significant revenue growth in 2012," commented William Moffitt, Nanosphere's president and chief executive officer.